Exploring consumer sentiment of essential communications

According to our research, 82% of consumers indicated they value essential communications from their personal banking provider. This has remained unchanged since our 2021 survey.

From fraud alerts to policy updates, every interaction customers have with their bank shapes their perception of their entire banking experience.

In a world where financial decisions are deeply personal, understanding how individuals react to and perceive essential communications becomes integral for the banking industry's evolution.

In this focused report, we'll explore consumer reactions to essential communications in the personal banking industry, to help financial institutions identify where and how they should focus their efforts to improve their customer experience.

of consumers value essential communications from their personal banking provider

of consumers worry about security and electronic fraud

We asked respondents what movie genre best reflects their banking provider’s communications

They chose documentary!

When we asked consumers to choose a movie genre that best reflected how they feel about essential communications from their banking provider, this is what they chose.

This means that while consumers view essential communications from their bank as factual and informative, they are possibly lacking in engagement or personalization.

Providing communications in your customer’s channel of choice is key. By meeting customers on the journey they choose, you are more likely to capitalize on the convenience and timeliness effects of your communications and therefore drive brand loyalty.

How do consumers interact with banking communications?

While many consumers use mobile apps to manage banking activities, when it comes to essential communications like statements, 54% of consumers prefer to receive these via email.

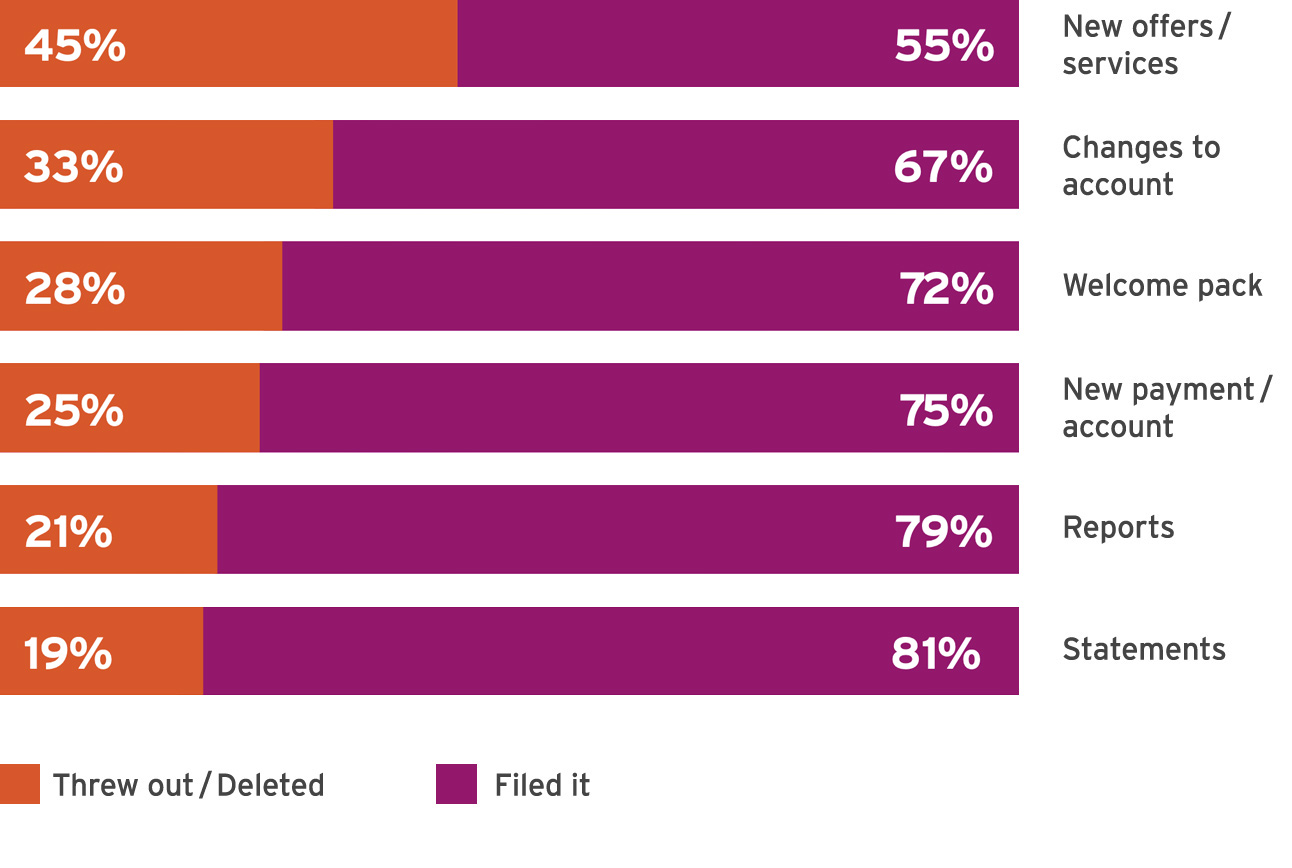

Which communications are destined for the trash?

New offers/services

Welcome pack

Most frequently opened and read in full

Notice about changes to account

Notice when setting up new payment/account

What do consumers do with essential communications?

When communications are unclear...

Millennials and Gen Z are twice as likely to throw out or ignore communications if they are unclear when compared to Boomers.

How do banking customers feel about security and fraud?

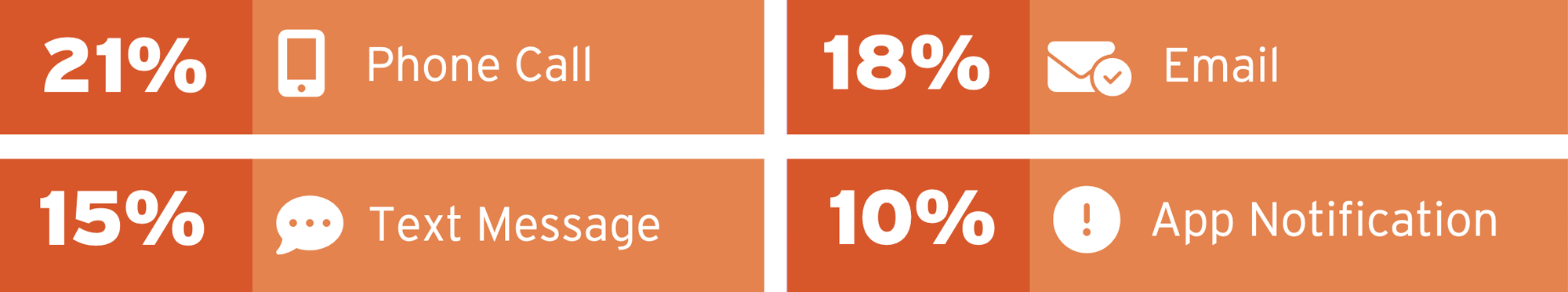

While phone calls, emails and text messages are amongst the most popular tools in the cybercriminal and scammer toolkit, these channels are also the preferred contact points for banking customers in the event of fraudulent or suspicious activity on their account.

The most effective channels to protect against security and electronic fraud.

We are Computershare Communication Services

Now that you understand more about the ways customers react to your essential communications, which of the learnings we've shared can you implement into your communications approach and strategy?

Contact us

Computershare Communication Services

Latest Communication Services insights

View all insights

The customer connection: insights into banking communications

The hidden costs of unclear B2C communications

Beyond the inbox: Why print still has a place in the digital age

The end of “Dear Valued Customer”: Crafting truly personal banking moments

Message matters: what consumers want from their banking communications

Outsourcing your customer communications: your key to agility

The importance of layout in customer communications

The importance of color in customer communications

Improving shareholder experience for greater customer satisfaction

Stop the Churn: 3 Tips to Elevate Your Customer Communications