Corporate actions, expertly managed

Corporate actions of any size or complexity are critical events for your company, and you need to be sure your deal is executed quickly, efficiently and accurately. With Computershare as your partner, you will benefit from our decades of experience managing every type of corporate event and our full range of corporate actions services, including our web portal. We can assist your company, even if Computershare is not your transfer agent.

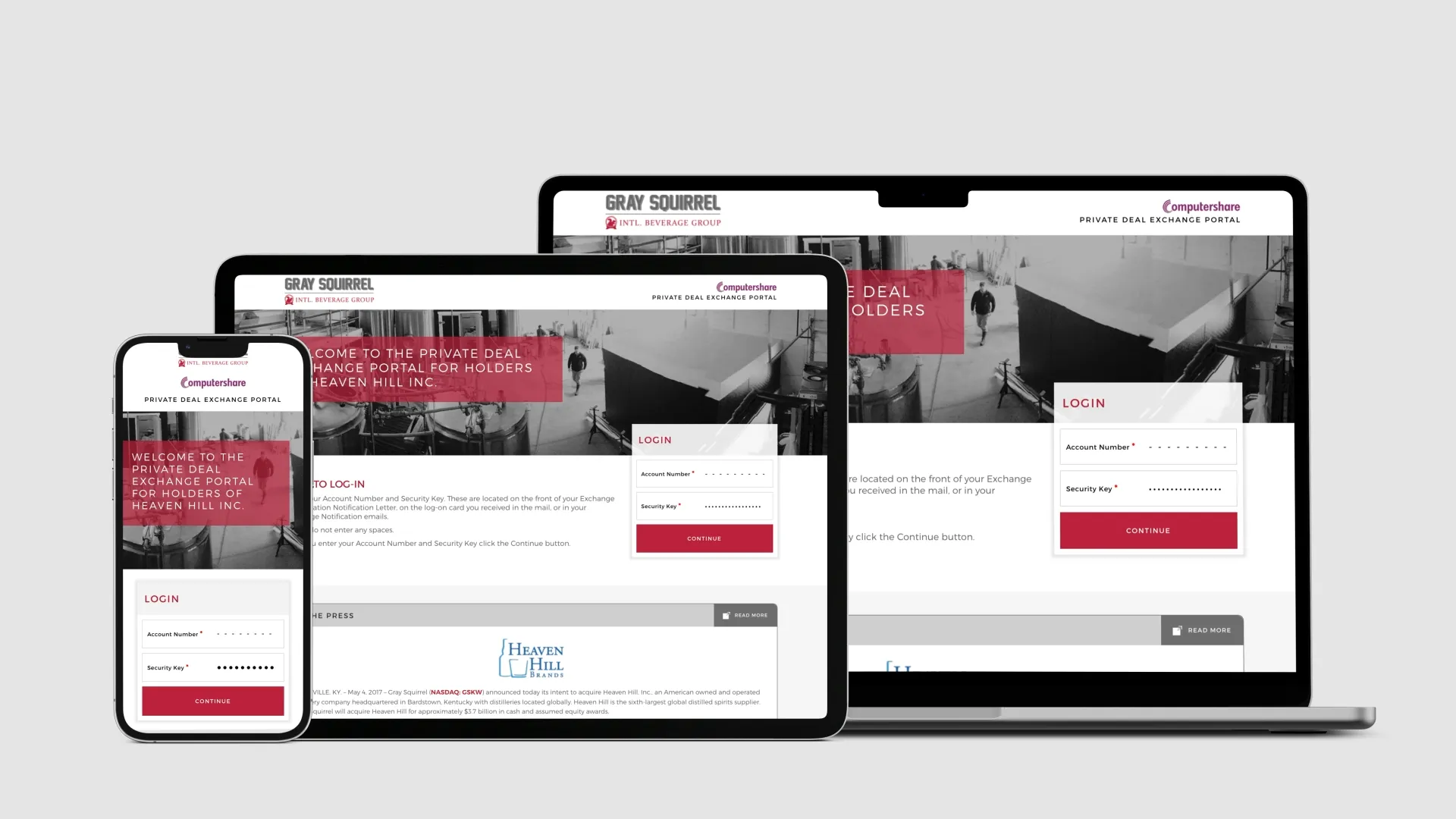

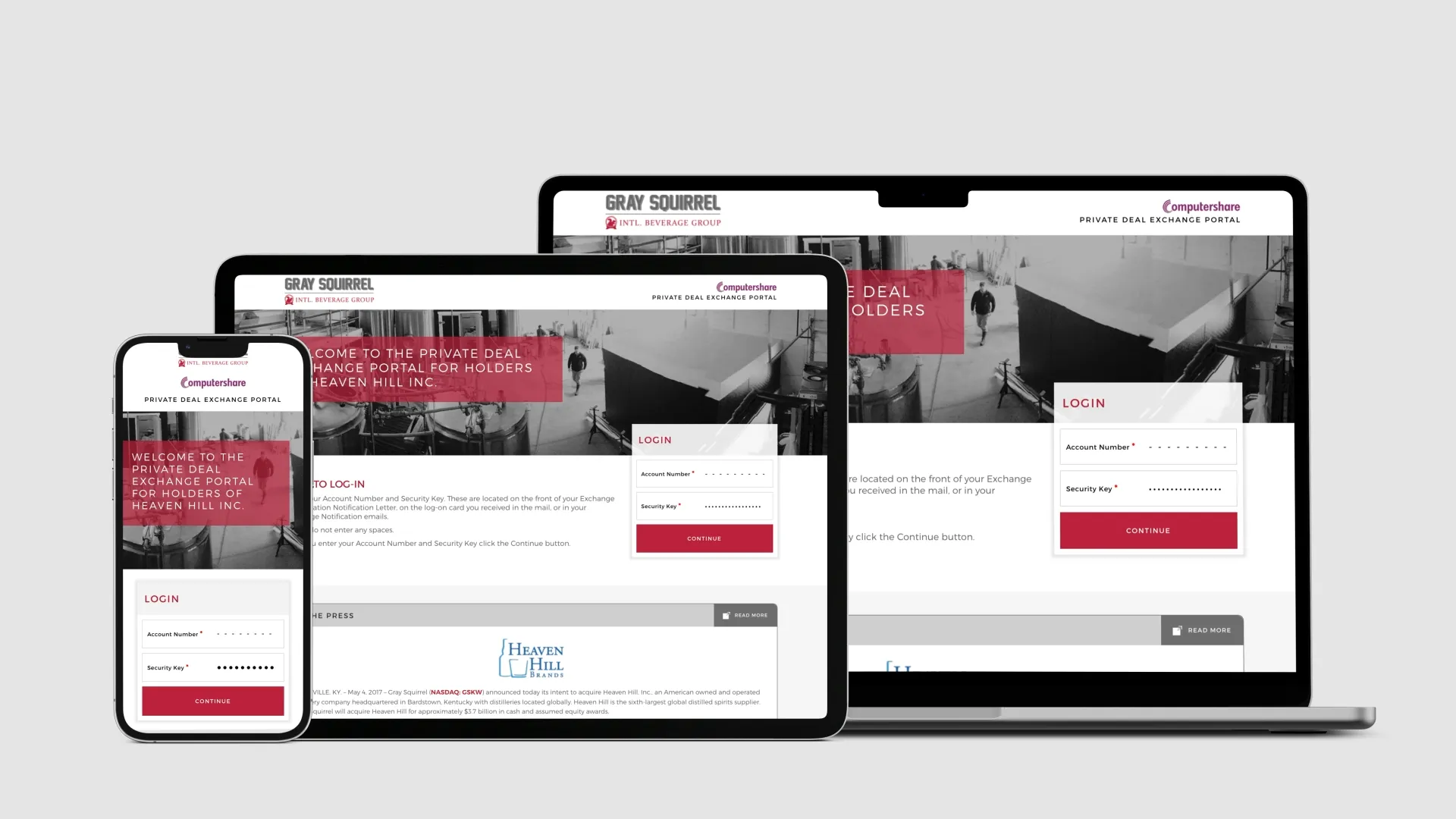

Corporate actions portal

Your shareholders can complete their transactions online, using an intuitive web portal with navigation that guides them through the process and provides immediate confirmation of their instructions.

Benefit from specialized corporate actions expertise

Corporate event highlights

Each year, Computershare completes corporate events for a wide range of clients. We would be pleased to help you with your next deal.

public and private M&A transactions

distributed entitlements

Who we help

Law firms

Your clients rely on you for guidance on important decisions and transactions. Choose a partner that understands those needs and has the expertise and services to handle whatever situations may arise.

Treasurer

With responsibility for your company’s financial activities, you need a partner with experience in even the most complex global transactions to manage risk and ensure your corporate action runs smoothly.

Our latest insights

View all insights

Reimagining shareholder experiences to deliver enhanced service and value

Fireside chat with Gordon Giffin, Former US Ambassador to Canada

Trends in the ever-evolving M&A environment

Retail voting program: What issuers need to know

Knowledge protection: Examining security, privacy and intellectual property

A partner for every stage of your M&A/corporate action

Corporate actions and M&A events can be demanding for your company and management team. That is why you want to work with one partner with expertise in every aspect of the transaction.

Related solutions

Escrow services

When you are executing a corporate action, we understand the need for escrow services tailored to your transaction. We offer complete escrow services managed by our experienced Corporate Trust team.

Unclaimed property

Unclaimed property should be part of the M&A due diligence process. Our consulting services can help limit the risks of unclaimed property non-compliance.

Global capital markets

Our unique Global capital markets helps you manage your listing in multiple markets. Our team provides a wide range of products and services – register, corporate events, plan types and more – tailored to your global needs.

Our team

Neda Sheridan

EVP, Corporate Actions

Thomas Borbely

Sr. Manager, Corporate Actions

Collin Ekeogu

VP and Director, Corporate Actions

Alexa Concepcion

Sr Manager, Corporate Actions

Scott Travis

VP, Corporate Actions

Stephanie Harmon

VP, Corporate Actions

Michael Duncan

SVP, Business Development, Corporate Actions

Erik Schwendenman

EVP, Business Development, Corporate Actions

Martin Curran

VP, Business Development, Corporate Actions

Neda Sheridan

EVP, Corporate Actions

Neda Sheridan joined Computershare Trust Company of New York as the Assistant Vice President of Relationship Management in March of 2001. Neda was appointed Assistant General Manager of Computershare Trust Company of New York in 2004 and assisted in the conversion of transactions from New York to Canton, MA. Neda currently has P&L responsibility and oversees the US Corporate Actions Teams for Computershare reporting to the President of US Equity Services.

The Corporate Actions Team consists of Relationship/Account Management, Operations (processing unit), Funding, Reconciliation, Escheatment and Product and provides services for a wide range of voluntary and mandatory transactions. Neda is a current and active Board of Director on the SIFMA Corporate Actions Board and chairs the SIFMA CA – Issuer Engagement Committee. Neda is also and member of the STA and co-chairs the STA corporate actions committee.

Prior to Computershare, she worked as a Cash Manager for the Treasury department of Omnicom Group, Inc., a global advertising holding company where her responsibilities included tracking and monitoring cash positions of over 150 company subsidiaries. In addition to Cash Management at Omnicom, Neda analyzed debt-refinancing options, managed the treasury stock repurchase program, and maintained banking relationships. Prior to Omnicom, Mrs. Sheridan worked on the CMBS trading floor with the Principal Transactions Group of Credit Suisse First Boston in Manhattan where she researched innovative asset types for investment purposes and securitizations for clients ranging from financial institutions and government agencies, to public and private commercial real estate. Neda obtained her Bachelor’s Degree in Strategic Management with specialization in Marketing and Computer Information Systems from The University of North Texas.

Thomas Borbely

Sr. Manager, Corporate Actions

Thomas Borbely is a seasoned corporate actions expert with extensive, broad based experience across the financial services industry. He has managed the full range of corporate action and reorganization events – across all structures, complexities, and markets—and leads a front office team handling high value M&A and reorg activity. With a background in transfer agency, recordkeeping, and process and system development, Thomas is recognized for his end to end operational insight and ability to deliver precision and results in high pressure, rapidly evolving environments.

Collin Ekeogu

VP and Director, Corporate Actions

Dr. Collin Ezemma Ekeogu serves as the Vice President and Director of Corporate Actions at Computershare Investor Services, where he leverages over twenty-five years of extensive experience in the financial services sector to drive transformational change and operational excellence. In his current role, Dr. Ekeogu is instrumental in managing and coordinating complex mergers and acquisitions events, ensuring that these critical transactions are executed seamlessly for a diverse portfolio of clients. His leadership encompasses a dedicated team of relationship managers and account administrators, who collectively oversee a Corporate Actions client base that generates approximately $900 million in annual revenue.

Alexa Concepcion

Sr Manager, Corporate Actions

A 25+ year veteran of the industry, Alexa Concepcion began her career at Computershare in Corporate Actions, the global leader in transfer agency. She then transitioned into a similar role at Morgan Stanley before processing Corporate Actions at Barclays Capital, an institutional broker dealer, notably DTCC for seven years. She also worked at Kroll as the Director of Global Corporate Actions in bankruptcy. She has developed a significant amount of experience managing corporate actions within the industry over the past twenty-five years. In July 2021, Alexa returned to Computershare as Senior Manager of the Corporate Actions Web Team after 20 years. She oversees the development from inception to completion of all our web corporate actions events.

Scott Travis

VP, Corporate Actions

Scott Travis is a Team Lead in the Corporate Actions, Mergers & Acquisitions department. He oversees a team of Solution Architects and Solution Engineers, coordinating service strategy deliverables across multiple corporate action and merger events. Additionally, Scott supports the sales organization as a subject matter expert for web portals, providing demo support and developing sales enablement and training materials.

Scott joined Computershare in 2000 after working in the hospitality industry. His journey began at EquiServe, a Computershare acquisition, where he held a client relationship position on the dedicated IPO team. Following the decline of the IPO and dot-com era, he transitioned to a client management team, handling proxy meetings, dividends, and serving as the day-to-day contact for over 50 clients. In 2003, Scott moved to Mergers & Acquisitions as a Relationship Manager, managing over 50 events annually, including cash and stock mergers, Dutch auctions, elections, and rights offerings. He assumed the Team Lead role in 2019, supporting the broader Mergers & Acquisitions team.

Stephanie Harmon

VP, Corporate Actions

Stephanie Harmon is a proven leader in Computershare’s Corporate Actions department, where she drives the successful execution of complex corporate action events for global clients. As Team Lead, she partners with internal teams and external stakeholders to deliver innovative, strategic solutions that ensure operational excellence and an exceptional client experience.

Since joining Computershare in 2007, Stephanie has managed more than 500 transactions for over 260 clients, including some of the world’s most recognized companies. Her expertise spans mergers, acquisitions, tender offers, and voluntary events, making her a trusted advisor for organizations navigating high-stakes corporate transactions.

Stephanie’s career reflects a deep commitment to process improvement, cross-functional collaboration, and client success. Prior to her leadership role, she built a strong foundation in tax reporting at Investors Bank & Trust and EquiServe (now part of Computershare). Today, she continues to lead initiatives that streamline operations and deliver measurable results for clients worldwide.

Michael Duncan

SVP, Business Development, Corporate Actions

Michael Duncan is a financial professional with over 30+ years of experience specializing in M&A consultative & processing services, including but not limited to the following: Special Purpose Acquisition Companies ("SPACs"), Cash & Stock Mergers, Tender & Election Offers, Reverse Morris Trusts, Unclaimed Property Recovery & Escheatment. Michael holds a BA from Villanova University.

Erik Schwendenman

EVP, Business Development, Corporate Actions

Erik Schwendenman is a Vice President of Business Development at Computershare and has over 28 years of M&A experience. Throughout his 30+ year tenure with the firm Erik has worked in numerous roles including managing a call center team and serving as a Project Manager coordinating and overseeing multibillion-dollar mergers and acquisitions, before transitioning into a business development role. Erik has participated in various capacities in over 2,000 M&A deals. In 2009, Erik joined Computershare’s wholly owned subsidiaries, Georgeson and Georgeson Securities, currently representing all three business lines. Erik is also a Registered Representative with his Series 7 & 63 licenses.

Martin Curran

VP, Business Development, Corporate Actions

Marty is responsible for developing shareholder services solutions for complex mergers, acquisitions and other corporate transactions. Such transactions include: tender offers, cash / stock elections, exchanges, demutualizations, rights offerings, employee stock option exchanges and bankruptcy distributions.

Marty has been in the shareholder services business for over 25 years and has managed hundreds of exchanges and tender offers. Some recent deals include the Verizon acquisition of the Verizon Wireless stake from Vodafone, the Actavis acquisition of Allergan, the H. Lundbeck A/S offer to purchase Chelsea Therapeutics and the Georgia Gulf acquisition of the PPG Industries chemical business.

Marty is a member of the National Investor Relations Institute (NIRI), the National Association of Stock Plan Professionals (NASPP) and the Shareholder Services Association (SSA). He is a graduate of the State University of New York’s Empire State College, holds a Retirement Plan Associate (RPA) designation from the Wharton School of Business and a Certified Equity Professional (CEP) designation from Santa Clara University. He also holds NASD Series 7 and Series 63 stockbroker licenses.

Let’s talk

Complete the form to speak to a Computershare expert about how we can help you execute your next corporate event.