Expertise for every listing event

Your company is going public. As your transfer agent, we have the experience and deep expertise to support you through every stage of your initial public offering (IPO). The world's leading companies have trusted Computershare to guide them through IPOs, SPAC transactions, and direct listings – from routine offerings to the most complex market events.

Your partner in defining moments

Companies choose Computershare for our proven expertise and decades of complex transaction experience.

of all US large cap IPOs from 2020-2024

US IPOs from 2020-2024

of the S&P 500 trust us as transfer agent

Why leading firms choose Computershare

Your IPO is just the start. After guiding you through the IPO process, we build a long-term partnership to provide ongoing service expertise that allows you to thrive as a listed company.

Expert management for your listing event and follow-on transactions

Cross-border listings

With the extensive expertise of our Global Capital Markets team, clients navigate the complexities of cross-border listings including stamp duty requirements, tax implications, special eligibility applications, and dual listings, including setting up depositary receipt or depositary interest facilities in other jurisdictions.

Direct listings

Computershare leads in US direct listings, including expertise in reverse stock splits, class consolidates and DTC eligibility. Our team understands the complexity and time-sensitive nature of these transactions, ensuring timely communication to holders and share delivery to brokers for market listing.

SPACs and De-SPACs

Computershare provides comprehensive services for each stage of a SPAC’s progression, including pre- and post-IPO activities, De-SPAC, and the ongoing registry and corporate governance services needed for life as a newly public company.

Lock-up release

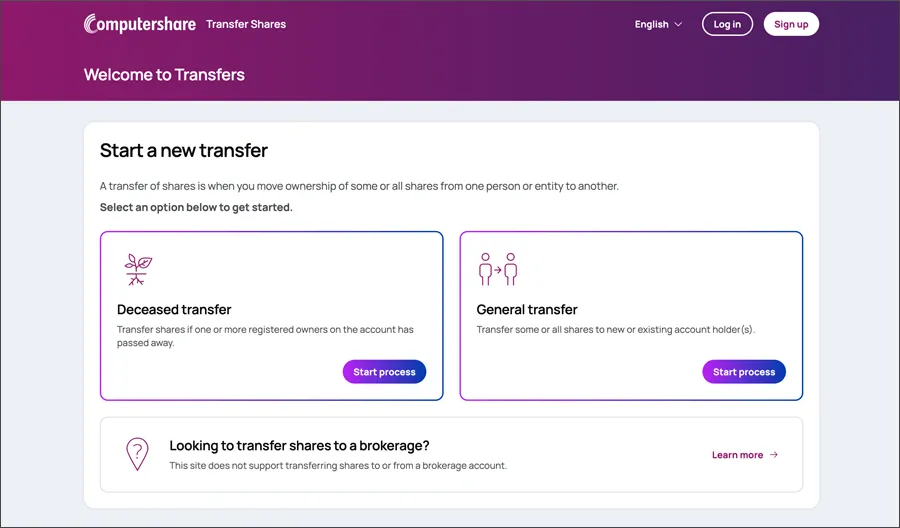

Our IPO experts coordinate document requirements and work with equity plan administrators, company contacts or counsel to deliver shares from initial investors and RSU vestings at IPO. Clients can open an omnibus account to hold shares to be delivered to a plan provider for streamlined delivery. Our teams can also deliver seamless early or day-one lockup releases if required.

Dual class / Up-C structures

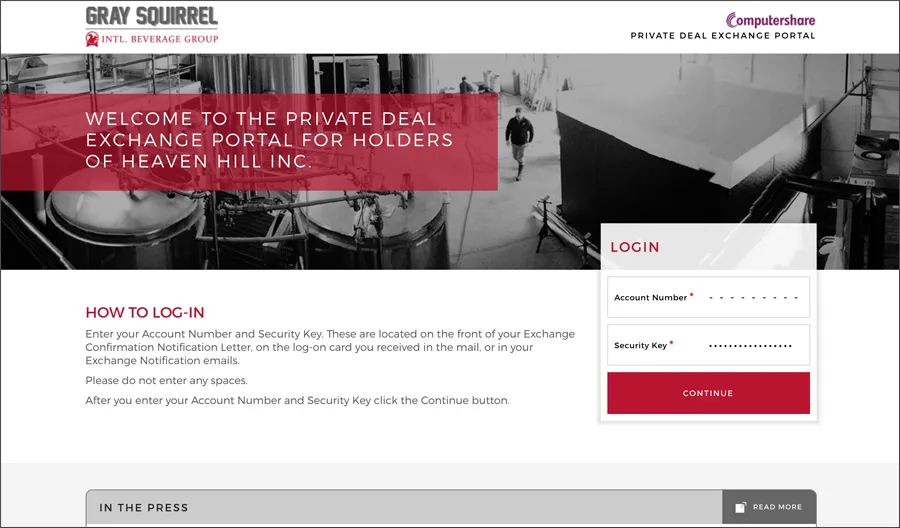

We support clients with dual or multiple class structures, including record keeping post-LLC units and publicly traded company classes for clients with an Up-C structure. For dual-class structures, shareholders conveniently request an exchange of non-trading class to trading-class shares through our online service.

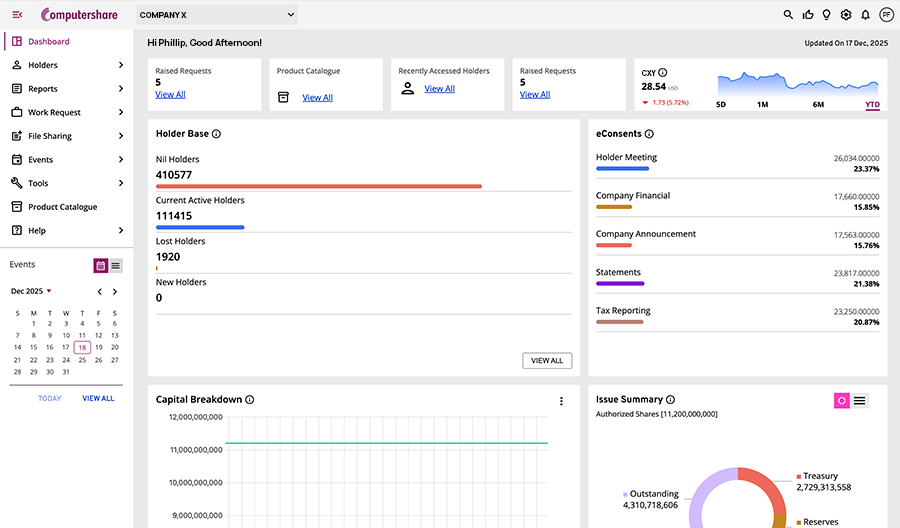

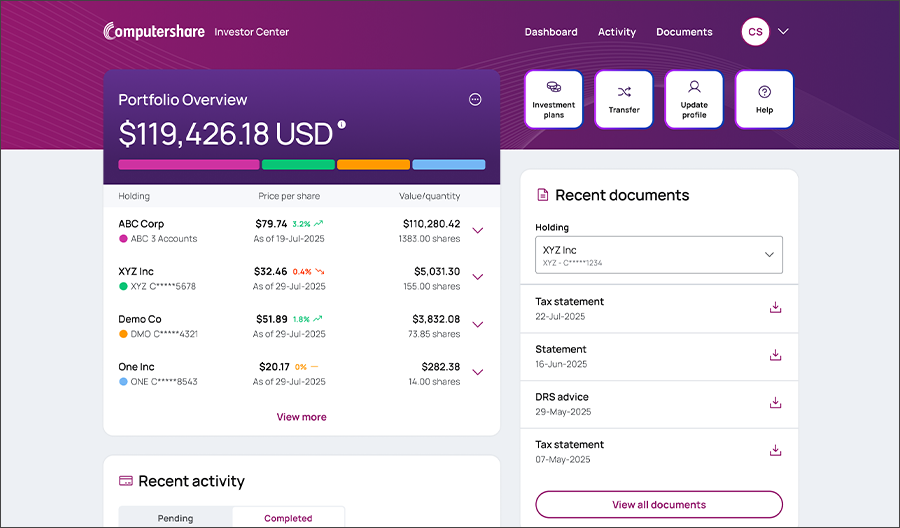

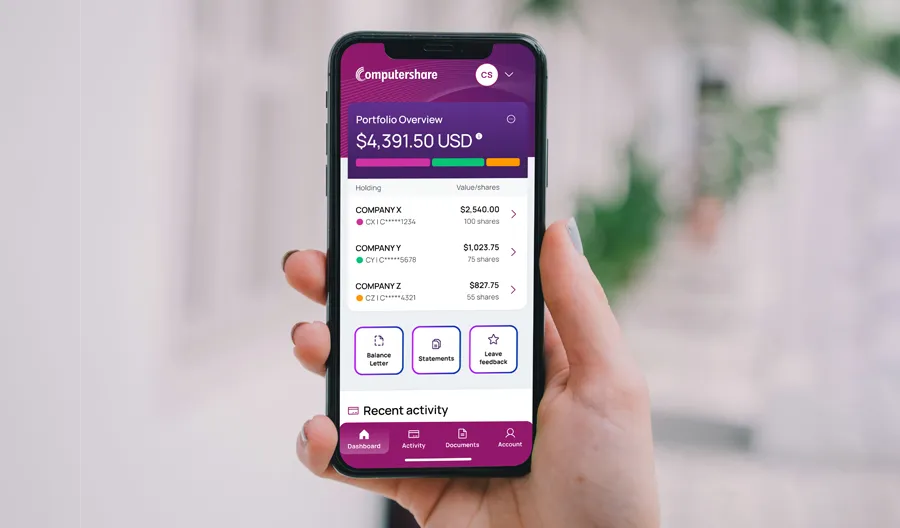

Technology to empower and inform

The next generation issuer portal provides easy access to shareholder information, powerful capital management and advanced reporting and analytics.

Help with your SPAC / De‑SPAC transactions

Comprehensive services for each stage of your SPAC, including pre- and post-IPO activities, De-SPAC, and ongoing registry and corporate governance services.

Our latest insights

View all insights

Reimagining shareholder experiences to deliver enhanced service and value

Fireside chat with Gordon Giffin, Former US Ambassador to Canada

Trends in the ever-evolving M&A environment

Retail voting program: What issuers need to know

Knowledge protection: Examining security, privacy and intellectual property

Related solutions

Annual meetings

Our customizable portfolio of annual meeting services allows you to select the meeting components that are most important for your company, with in-person, virtual and hybrid options.

Investor engagement

Investor Engagement brings together best-in-class software, intelligence and advisory capabilities that empower companies to discover who holds hidden investor power, target engagements with purpose, and drive successful outcomes with confidence.

Employee equity plans

We support all major employee plan types, from incentives for your leadership team to share purchase plans for all employees and country specific reward programs.

Let’s talk

If you are considering going public, you will need an experienced transfer agent. Learn more about our full range of solutions for your IPO and moving forward as a public company.