Capital Solutions

Managing high-value restricted stock transactions is always time-sensitive and they need to be executed quickly and accurately, with no surprises. Computershare’s Capital Solutions service delivers premium white-glove transaction support and a digital platform for brokers and fund managers that offers real-time access to account information and priority processing to keep your deals moving.

White-glove restricted stock processing and transaction services

Assistance with all types of transactions and inquiries

Restricted stock transactions

When selling or transferring shares, we can expedite the removal of restrictions for all or a portion of shares, which may include a restricted-to-restricted transfer. We can also provide assistance before and after lock-up release.

Distributions

For these often time-sensitive transactions, we facilitate the removal of restrictions to enable the movement of clean shares to a broker, or the issuance of restricted shares to affiliates, according to your schedule.

Rule 10b5-1 priority processing

To process your urgent transactions, we can remove the restrictions within 24 hours to enable shares to be delivered to the broker to settle the trade.

Expedited, prioritized transactions

We offer white-glove services, giving you a single, consistent point of contact and dedicated operations team for your most time-sensitive, high-value, priority transactions.

Simplified account management

Streamlined account inquiries offer a quick and convenient way to verify information and make updates to registered shareholder accounts, including address changes, payment instructions, and tax certification status.

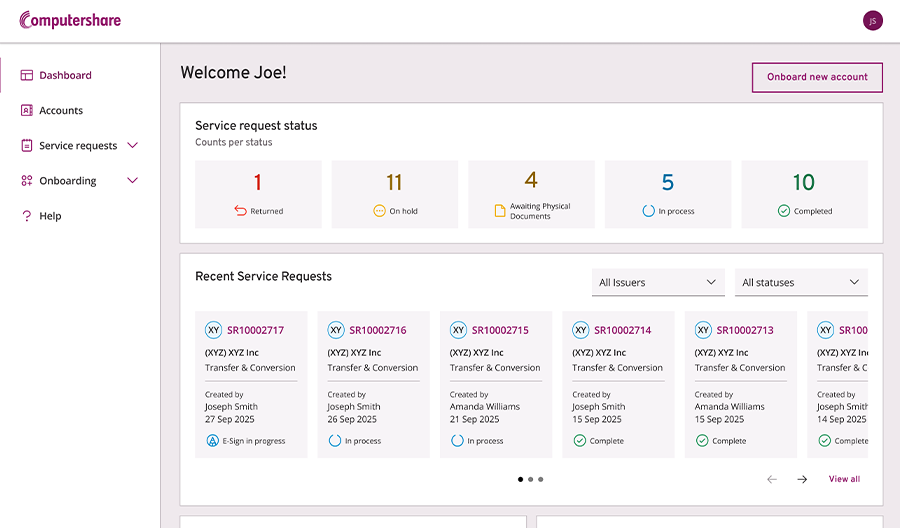

Capital Solutions digital platform

To offer clients easy and intuitive service experiences, we continue to innovate and invest in our platform, using client feedback to enhance engagement.

An interactive dashboard with transaction activity metrics

A snapshot of recent service requests

Real-time status of requests in progress

Digital shareholder onboarding workflow

Account registration and shareholder tax information

Details regarding cost basis and restrictions

Our latest insights

View all insights

Reimagining shareholder experiences to deliver enhanced service and value

Fireside chat with Gordon Giffin, Former US Ambassador to Canada

Trends in the ever-evolving M&A environment

Retail voting program: What issuers need to know

Knowledge protection: Examining security, privacy and intellectual property

Our team

Bill Atkinson

SVP, Capital Solutions

Ann Bowering

CEO Issuer Services, North America

David Adamson

EVP, Client Relationship, Issuer Services

Bill Atkinson

SVP, Capital Solutions

Bill Atkinson is an accomplished leader with over 20 years of experience in corporate strategy, finance, product development, and business development. He has worked with Fortune 500 companies and high-growth tech start-ups. Before joining Computershare, Bill held corporate development roles at tech start-ups and an Omnicom-owned digital agency, where he led venture funding and acquisitions.

Bill joined Computershare in 2003 to support rapid US growth, contributing to hundreds of millions in M&A transactions. He later led the US strategic innovation program and played a key role in the Global Capital Markets team, creating new services and business units that generated significant revenue. Most recently, he helped design the Capital Solutions business model and digital platform. Today, Bill focuses on developing and managing institutional client relationships with leading investment firms.

Ann Bowering

CEO Issuer Services, North America

As CEO of Issuer Services North America, Ann Bowering is responsible for the leadership, growth and day to day management of the Issuer Services business.

Before joining Computershare in 2019, Ann was the Managing Director and CEO of NSX Limited. While there, Ann led the execution of an essential, and very significant restructure of the operations, people and culture, and strategy of the company.

Ann has over 20 years’ experience in financial markets. Her expertise in the development and operation of licenced and regulated financial markets stems from her time as a director and CFO of the derivatives exchange Financial & Energy Exchange Limited. She also held senior positions at Lucsan Capital and KPMG, where her roles covered the specialisations of Capital Markets Advisory, Risk Management, and Assurance.

David Adamson

EVP, Client Relationship, Issuer Services

Dave Adamson is a seasoned financial services leader with over 30 years of expertise in strategic relationship management. As Executive Vice President, he directs a national team responsible for strengthening client partnerships within the registry and depository receipts business.

Dave drives Computershare’s client service strategy, ensuring delivery of tailored solutions that extend beyond core transfer agency services. He collaborates with the global network to design innovative service models and partners with sales leadership to accelerate growth and expand market opportunities.

Since joining Computershare in 2004, Dave has played a pivotal role in shaping client engagement strategies. His prior experience includes managing complex Fortune 500 retirement plan relationships at The Northern Trust Company.

Dave currently serves as the President of the Society for Corporate Governance – Chicago Chapter.

Related solutions

Initial public offering (IPO)

Our specialized teams in the US and around the globe have a strong track record guiding IPOs, SPAC programs and direct listings, from the routine to the most complex events.

Corporate actions

We have decades of experience managing every type of corporate event and a full range of corporate actions services, including our web portal.

Alternative investments

We deliver a flexible, full-service transfer agency solution for alternative investments – including non-traded REITs and BDCs – tailoring our services to meet your company’s specific needs.

Let’s talk

As the transfer agent for nearly 60% of large cap IPOs in the US, Computershare provides the governance, legal, compliance and risk posture that matches the size, scale and sophistication that is expected of the critical infrastructure we supply to highly regulated financial markets.

Contact us for more information on our Capital Solutions group.