Why Choose Computershare for your Special Purpose Acquisition Company (SPAC) Transaction?

Going public is one of the most paramount moments in a company’s history, and the main paths to the public market – traditional IPOs, direct listings, or Special Purpose Acquisition Companies (SPACs) – can be complex with a myriad of idiosyncrasies. Successful SPAC IPOs require building a strong team of professional advisors, and your choice of transfer agent is a critical component to a successful launch and beyond.

As a leading provider of IPO services in the US and around the globe, Computershare is uniquely positioned to provide services for SPAC IPOs. With decades of collective experience, we’ve worked on some of the largest and most complex transactions in the world.

Comprehensive SPAC/De-SPAC transaction services

Computershare provides comprehensive services for each stage of a SPACs progression, including pre- and post-IPO activities, De-SPAC, and the ongoing registry and corporate governance services you/your clients need for life as a newly public company.

Our full-service delivery model, focused on providing SPAC issuers with a centralized and simplified approach improves the ease of doing business, and includes the following:

Save time, save money

Focus on your most important priorities as a newly public company with confidence – knowing that Computershare will execute every step with precision.

Exceptional quality, responsive customer service

When accuracy and fast turnaround are critical during your most high profile, high stake moments, Computershare delivers. Our expert SPAC support team has decades of experience on hundreds of IPO transactions – including the most complex and groundbreaking. We’re focused on providing you/your clients with high quality, responsive customer service throughout the life cycle of your SPAC.

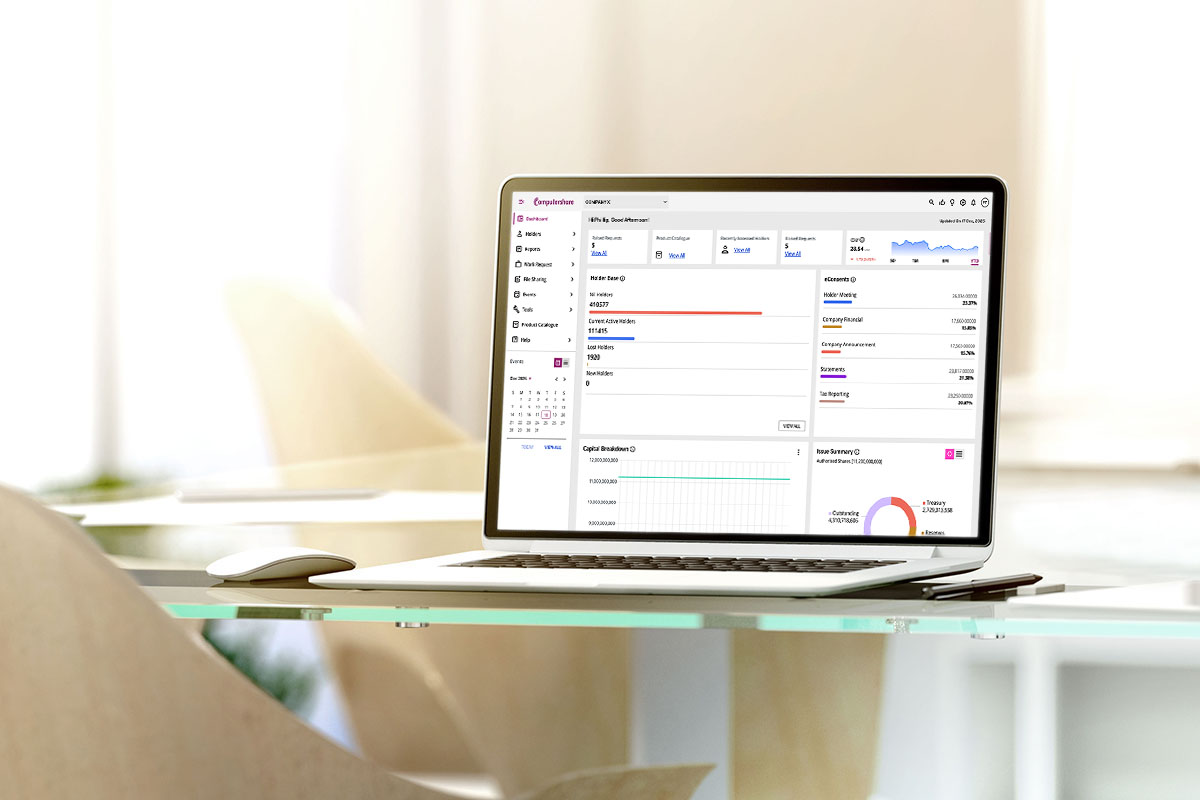

Industry leading technology

Hit the ground running with a partner that combines the right technology with the right support providing an optimal experience for you and your new investors. With real-time access to all your registry data in Computershare’s Sphere platform, business decision making has never been easier. Your investors will enjoy the simple, intuitive navigation and industry leading functionality of Investor Center to manage their investor portfolio online. And you’ll be able to offer your shareholders an ecosystem of modern communication channels such as online chat, traditional web, Interactive Voice Response (IVR) system and live customer service channels.

Our latest insights

View all insights

Reimagining shareholder experiences to deliver enhanced service and value

Fireside chat with Gordon Giffin, Former US Ambassador to Canada

Trends in the ever-evolving M&A environment

Retail voting program: What issuers need to know

Knowledge protection: Examining security, privacy and intellectual property

Related solutions

Annual meetings

Our customizable portfolio of annual meeting services allows you to select the meeting components that are most important for your company, with in-person, virtual and hybrid options.

Investor engagement

Investor Engagement brings together best-in-class software, intelligence and advisory capabilities that empower companies to discover who holds hidden investor power, target engagements with purpose, and drive successful outcomes with confidence.

Employee equity plans

We support all major employee plan types, from incentives for your leadership team to share purchase plans for all employees and country specific reward programs.

Let’s talk

Ready to learn more about the Computershare difference for SPAC IPO and De-SPAC transactions? Fill out the form to get in contact with us today.