Challenge #1

They were unable to develop effective investor engagement strategies due to limited insight into their beneficial holder base. Their existing reporting solution used incomplete and outdated information.

At the centre of this story is an Australian-based company that has been operating in the travel industry for over 15 years. Specialising in domestic and international travel products and services, they support companies both locally and abroad. This listed company has over 500 employees and more than 15,000 shareholders.

When COVID-19 brought the travel industry to a standstill, our client, like many companies across Australia, had to focus on safeguarding the future of their business. With regulations and restrictions changing every day, our client decided to explore new avenues to help them adapt and continue to move their business forward amid the uncertainty.

They were unable to develop effective investor engagement strategies due to limited insight into their beneficial holder base. Their existing reporting solution used incomplete and outdated information.

They needed to achieve positive voting outcomes at their Annual General Meeting (AGM) but were unable to confidently plan ahead due to constantly changing regulations.

Computershare worked with the Company Secretary and Chief Financial Officer to understand the exact nature of the challenges they were facing. After a comprehensive review, we offered the following solutions:

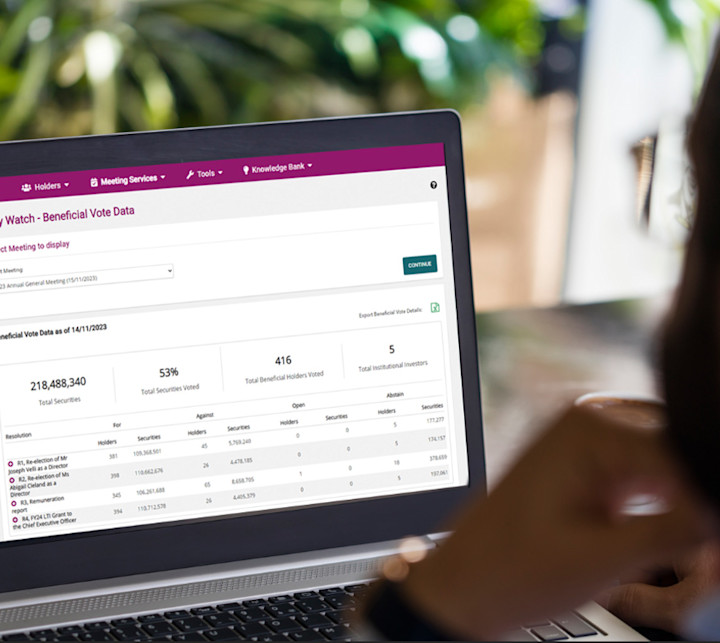

Real-time, 24/7 access to beneficial voting data which offers the opportunity to address any unexpected voting trends well in advance of the AGM.

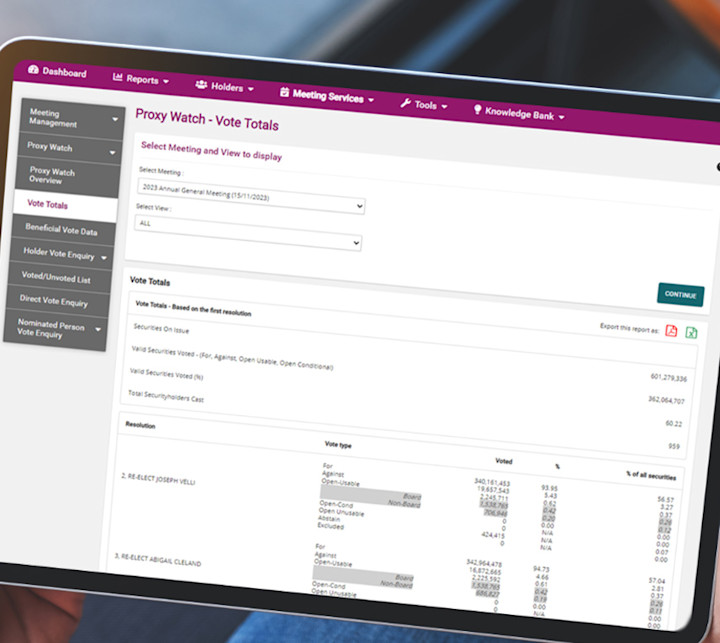

Integrates all voting results and provides 24/7 live visibility on voting, proxy tabulation and reporting (including proxy votes via mail and fax.)

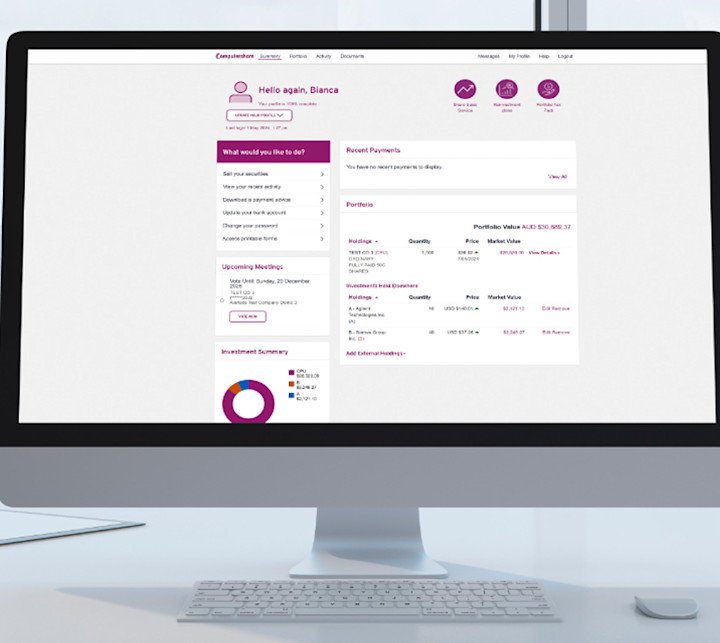

Provides a streamlined way for shareholders to vote online and submit questions relating to the company’s AGM resolutions.

Reporting offering accurate and up-to-date insight into beneficial holder trading behaviour, via our trusted partner Nasdaq.

Support and guidance from a team of meetings experts to navigate the complex regulatory environment.

Proactive account management and servicing from an experienced, dedicated relationship manager.

The in-depth investor relations reporting provided by Nasdaq enabled the client to better understand their underlying holder base. This, combined with Computershare’s comprehensive vote monitoring, tabulation and reporting, led to the client’s Board of Directors feeling empowered to develop truly effective investor engagement strategies, securing them positive AGM voting outcomes.

By partnering with Computershare, this listed company now has access to extensive expertise and proactive account management, providing them with confidence despite a continuously evolving market. Their dedicated relationship manager stands beside them every step of the way to answer questions and keep them informed.

Empower their board to engage with shareholders using our complete, accurate and timely investor relations reporting

Easily achieve and maintain compliance with our prompt market updates explaining key regulatory developments

Accurately budget every quarter with our predictable, transparent cost structure

Have confidence that all their registry needs are taken care of with our proactive approach to account management.

Computershare provides a broad range of products and services with share registry management and corporate actions being at the core of our business. We offer global coverage underpinned by local expertise and maintain a footprint in 22 countries around the globe. We have the teams, market insight and industry knowledge to guide our clients through even the most complex transactions.

Our strategic market relationships and deep understanding of the industry informs how we service our clients. While our focus is to deliver outstanding service today, we also simultaneously consider what the future holds, regularly engaging with the broader market to ensure our clients feel empowered to successfully navigate life as a listed company.

We have over 45 years’ experience supporting listed companies to achieve their strategic goals and with an average client tenure of 16 years you can rest assured you’re in safe hands with Computershare